lake county real estate taxes illinois

Lake County Ohio. Lake County 18 N County Street Waukegan IL 60085.

Franklin Park Water Tower Real Estate Appraisals In Chicago Suburbs Certified Appraisers Listed On The Fha Ros Franklin Park Water Tower Homeowners Guide

Illinois Property Tax Rates.

. 204 Lake Lorraine Drive Swansea IL 62226 Find homes for sale market statistics foreclosures property taxes real estate news agent reviews condos. Learn About Owners Year Built More. Yearly median tax in Lake County.

2021 Taxes Payable in 2022. Serving Lake County Illinois. County Median Home Value Average Effective Property Tax Rate.

Bring your tax bill and payment method cash creditdebit check or money order to the Lake County Treasurers Office located at 18 North County Street Room 102 Waukegan IL 60085. The median property tax on a 28730000 house is 301665 in the United States. 847-377-2000 Contact Us Parking and Directions.

Select Tax Year on the right. Only 1 tax hike in last 5 years and it was nominal. Our mission is to provide the best legal results at the most reasonable cost and to effectively communicate with clients throughout every stage.

Home Departments Treasurer Property Tax Due Dates. See Results in Minutes. The Law Offices of Liston Tsantilis PC.

Lake County collects on average 219 of a propertys assessed fair market value as property tax. 42 Best Places to Buy a House in Chicago Area. Lake Barringtin has lots of open spaces hiking trails parks and a free kids park at Village Hall.

Site Appearance Format Images. Lake County IL 18 N County Street Waukegan IL 60085 Phone. The office is open 830 am until 500 pm Monday-Friday excluding holidays.

See Property Records Tax Titles Owner Info More. Has gated community wgolf course lake and lots of beautiful single family homes. No warranties expressed or implied are provided for the data herein its use or interpretation.

Property Tax Change-of-Name Form Enter the 10 digit Property Index Number PIN with or without dashes for the property. Lake County collects the highest property tax in Illinois levying an average of 628500 219 of median home value yearly in property taxes while Hardin County has the lowest property tax in the state collecting an average tax of 44700 071 of median home value per year. Notice is hereby given that Real Estate Taxes for the First Half of 2021 are due and payable on or before Wednesday February 16 2022.

To pay your property taxes by phone call 877-690-3729. Please allow 2-3 business days for your online payment to post. The fee for a successful tax appeal is 35 of your first years savings.

We handle your tax appeal case from start to finish. Search Any Address 2. What is the property tax rate in Benicia CA.

Browse Lake County IL real estate. The exact property tax levied depends on the county in Illinois the property is located in. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on.

We thank you for your patience during this transition. Pay Mobile Home Property Tax. Be Your Own Property Detective.

Lake County 18 N County Street Waukegan IL 60085. No tax appeal fee. Ad Look Up Any Address in Illinois for a Records Report.

Lake County homeowners last year paid higher property taxes averaging 9186 than any other Illinois county and the new bills are. Lake County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. The median property tax on a 28730000 house is 497029 in Illinois.

The Lake County Property Records and Licensing Office make every effort to maintain the most accurate information possible. After clicking the button the status will be displayed below. The median property tax also known as real estate tax in Lake County is 628500 per year based on a median home value of 28730000 and a median effective property tax rate of 219 of property value.

2021 Taxes Payable in 2022. Select Home Page Menu Image. 105 Main Street Painesville OH 44077 1-800-899-5253.

Find 3478 homes for sale in Lake County with a median listing home price of 349900. Our tax appeal fee is contingent upon you receiving an assessment reduction. The median property tax in Lake County Illinois is 6285 per year for a home worth the median value of 287300.

Successful on over 90 of tax appeals. The median property tax on a 28730000 house is 629187 in Lake County. Some property characteristics are in the process of being updatedcorrected due to our recent conversion to a new property tax system.

Find Details on Illinois Properties Fast. Contact Us Monday-Friday 830am-500pm Location Google Map Website. Skip to Sidebar Nav.

How much are property taxes in Lake County IL. Search For Title Tax Pre-Foreclosure Info Today. Lake County has one of the highest median property taxes in the United States and is ranked 15th of the 3143 counties in order of median.

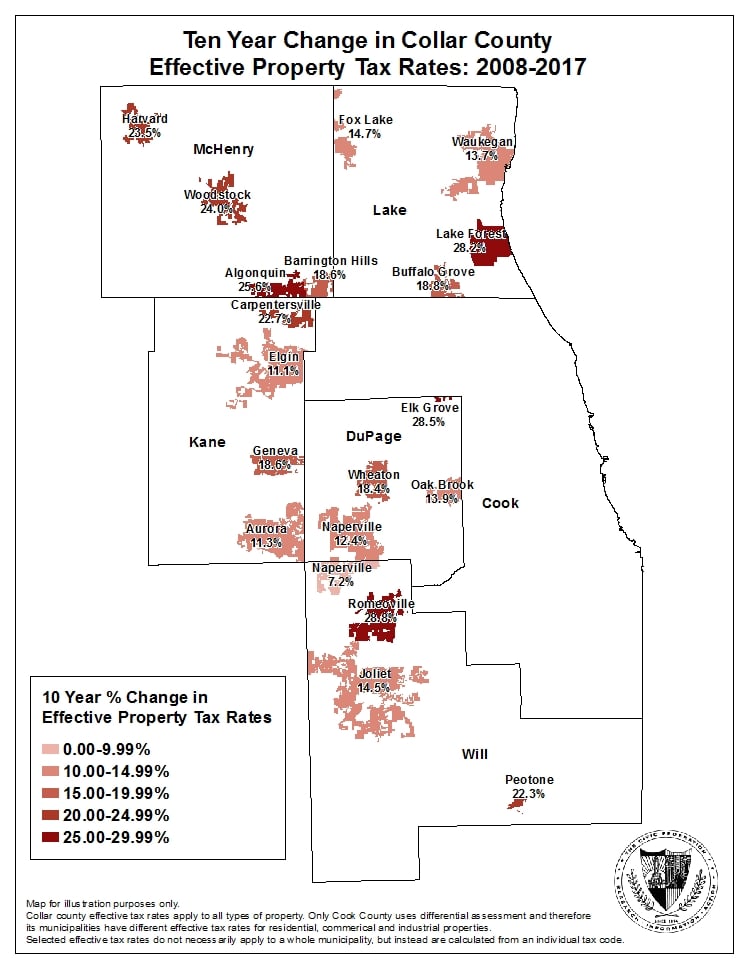

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

Lisle Township Assessor Lisle Property Tax Tax Rate

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

So True Realestate Humor Fred Real Estate Group Of Bend Oregon Real Estate Humor Real Estate Quotes Realtor Humor

The Cook County Property Tax System Cook County Assessor S Office

Lake County Il Property Tax Information

The Best School Districts In Illinois In 2014 As Ranked By Schooldigger Http Www Disclosurenewsonline Com 2015 01 25 Th School Fun School District Illinois

Lake County Real Estate Tax Appeal Estate Tax Lake County Illinois

Plano Illinois 60465 Water Tower Illinois Tower

Pin By Anne Liveandgrowtoday On Lake County Illinois Agentannecook Com Lake County Ingleside Beautiful Kitchens

North Central Illinois Economic Development Corporation Property Taxes

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

Township Assessors Get 3 000 Bonus For Doing Job Right Township Job Property Tax

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

Ogle County Illinois Illinois County United States

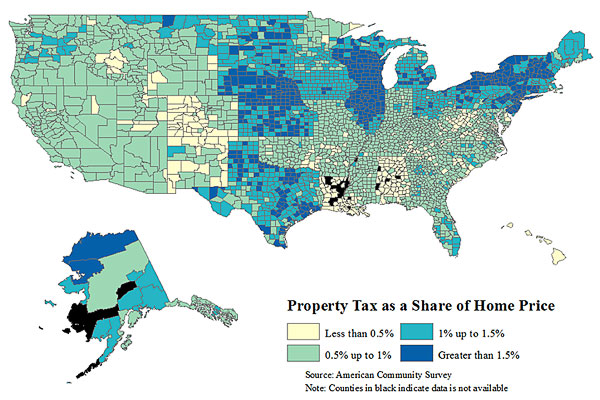

Illinois Now Has The Second Highest Property Taxes In The Nation Chicago Magazine